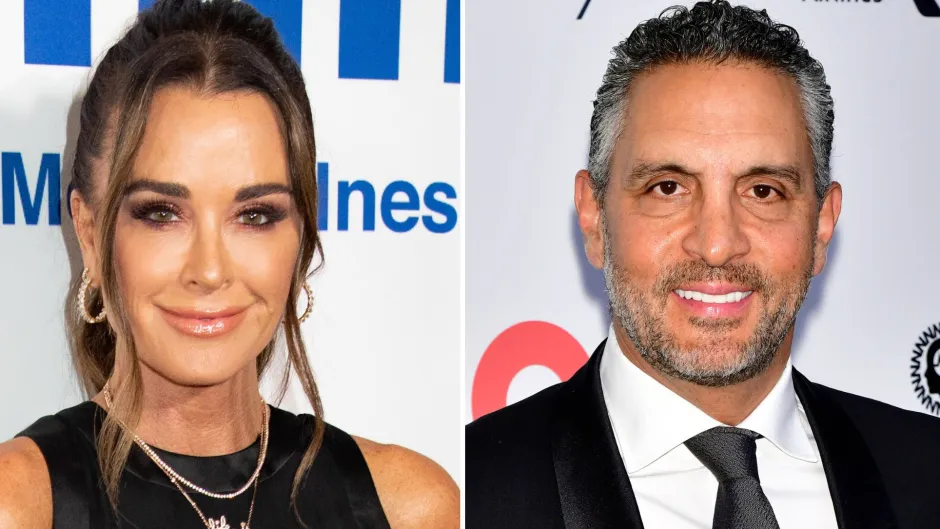

The Real Housewives of Beverly Hills star Kyle Richard’s ex Mauricio Umansky is being sued over a $3.5 million dollar PPP loan.

Real-estate agent Mauricio, 54, who was married to Kyle, 55, for 27 years, had filed for the Payroll Protection Program (PPP) and the CARES Act loan during the pandemic.

The purpose of the government loans was to provide businesses in need with financial help as the country battled COVID-19, so that the termination of its employees could be prevented.

Mauricio and his business partner William ‘Billy’ Rose were approved for the hefty amount of $3,521,153, for their luxury real estate company called The Agency.

In July 2023, Realtor LLC filed a violations complaint over The Agency’s alleged federal false claims act.

In Touch has obtained the court documents, which were recently unsealed, after being filed last summer.

The Agency went through two rounds of applications for the loans.

During round one, the luxury real estate agency requested $2.3 million, which was approved.

For round two, the brand applied for a loan of $1.1 million, which was also approved.

The suit stated: ‘Those two programs were enacted for the sole purpose of preventing termination of employees, by providing loans to businesses that were unable to pay them, due to the impact of COVID-19 – not to bolster or preserve the profits of a business that had sufficient funds available to pay its employees.

‘Yet, the vast majority of the proceeds went to those very businesses, leaving many small businesses like restaurants, grocers, and other small businesses that were directly impacted by COVID-19, through lost business out in the cold.

‘Many of the large, profitable businesses obtained their loans by misrepresenting their financial situations – claiming their businesses were eligible, when they were not, or by misrepresenting how the funds would be used.’

The filing continued: ‘Their profits would have been minimally impacted if at all, because their revenue was based on a percentage of real estate transactions, typically between millionaires and billionaires, not consumers who were unable to buy goods, or dine out because of the COVID-19 restrictions.

‘In fact, The Agency’s business grew massively during the COVID-19 pandemic.

‘This is a case about greed during a national health emergency.’

The lawsuit explained that in 2019, The Agency had six billion in sales volume, and in 2020, that increased to $6.5 billion.

It went on to emphasize that the company ‘ballooned to $11.2 billion in 2021.’

The suit continued: ‘In order to receive the loans, Defendants falsely certified that “current economic uncertainty makes this loan request necessary to support the ongoing operations of the Applicant,” and that they needed the loans to pay their employees, a requirement for eligibility for PPP loans.

‘In addition, the amounts they applied for and received, exceeded the loan limit of 2.5 monthly salary, with a cap of $100,000 annual salary per employee.

‘In addition to receiving loans based on these false certifications, Defendants later applied for, and received full loan forgiveness, knowing they were ineligible for the loans in the first place.

‘The PPP Loans were not necessary to support Defendants’ ongoing operations and pay their employees’ salaries, nor were they used for such purposes, because Defendants had ample liquidity to do so.

‘Instead, they only bolstered Defendants’ profits.’

The law suit continued: ‘Defendants’ business revolved around luxury real estate transactions of white-collar millionaires and billionaires, who were not impacted by the pandemic.

‘The Agency does not deal in starter homes, but luxury properties for the rich and famous, with their average sales price at $1.92 million.

‘This contrasts with small businesses, such as grocery stores, restaurants and other companies that sell other products and services, and who depend on a voluminous flow of customers.’

‘The fraud to protect profits here is all the more egregious, because [Mauricio] and [Billy], who co-own The Agency, are already extremely wealthy individuals, who each own tens of millions of dollars of real estate.

‘Reducing or foregoing distribution of profits, if necessary for a period of time, would not have made it financially impossible to keep their business in operation.’

Realtor demanded that the court forces each defendant to pay ‘three times the damages that the United States has sustained because of Defendants’ actions, plus a civil penalty of not less than $12,537, and not more than $25,076 for each, and every false claim, as are required by law.’

Maurico and The Agency have denied the claims.

A representative for The Agency shared with InTouch: ‘While we are unable to comment on ongoing litigation, we want to emphasize that The Agency has always operated with the highest level of integrity in all aspects of our business.

‘Like many companies, we faced significant challenges during the COVID-19 pandemic, including layoffs and cutbacks.

‘Our focus has always been, and especially during that challenging period, on delivering exceptional service to our customers and supporting our employees.

‘The claims in this case do not reflect the reality of our operations and financial situation at the time we filed for our PPP loans, and we intend to vigorously defend against these meritless claims.’

Kyle and Mauricio split during the same month that the lawsuit was brought on.